If you own a home on Chicago’s North Shore, you might wonder whether flood insurance is necessary. After all, we’re not exactly known for hurricanes or coastal storm surges. But flooding can happen anywhere—and when it does, the financial consequences can be devastating.

Let’s break down why flood insurance matters, your coverage options, and some important distinctions that could save you money and headaches down the road.

Why You Need Flood Insurance: Two Compelling Reasons

Managing Your Risk

Standard homeowners insurance doesn’t cover flood damage. If heavy rainfall overwhelms storm sewers, if snowmelt causes the nearby creek to overflow its banks, or if Lake Michigan or the Skokie Lagoons decide to make an unwelcome appearance in your basement, you’re on your own without flood insurance.

The North Shore has seen its share of significant rain events in recent years. Communities like Wilmette, Winnetka, and Highland Park have all dealt with flooding that’s left homeowners facing tens of thousands of dollars in damages. Your home is likely your largest financial asset—protecting it from flood risk just makes sense.

Your Mortgage Lender Requires It

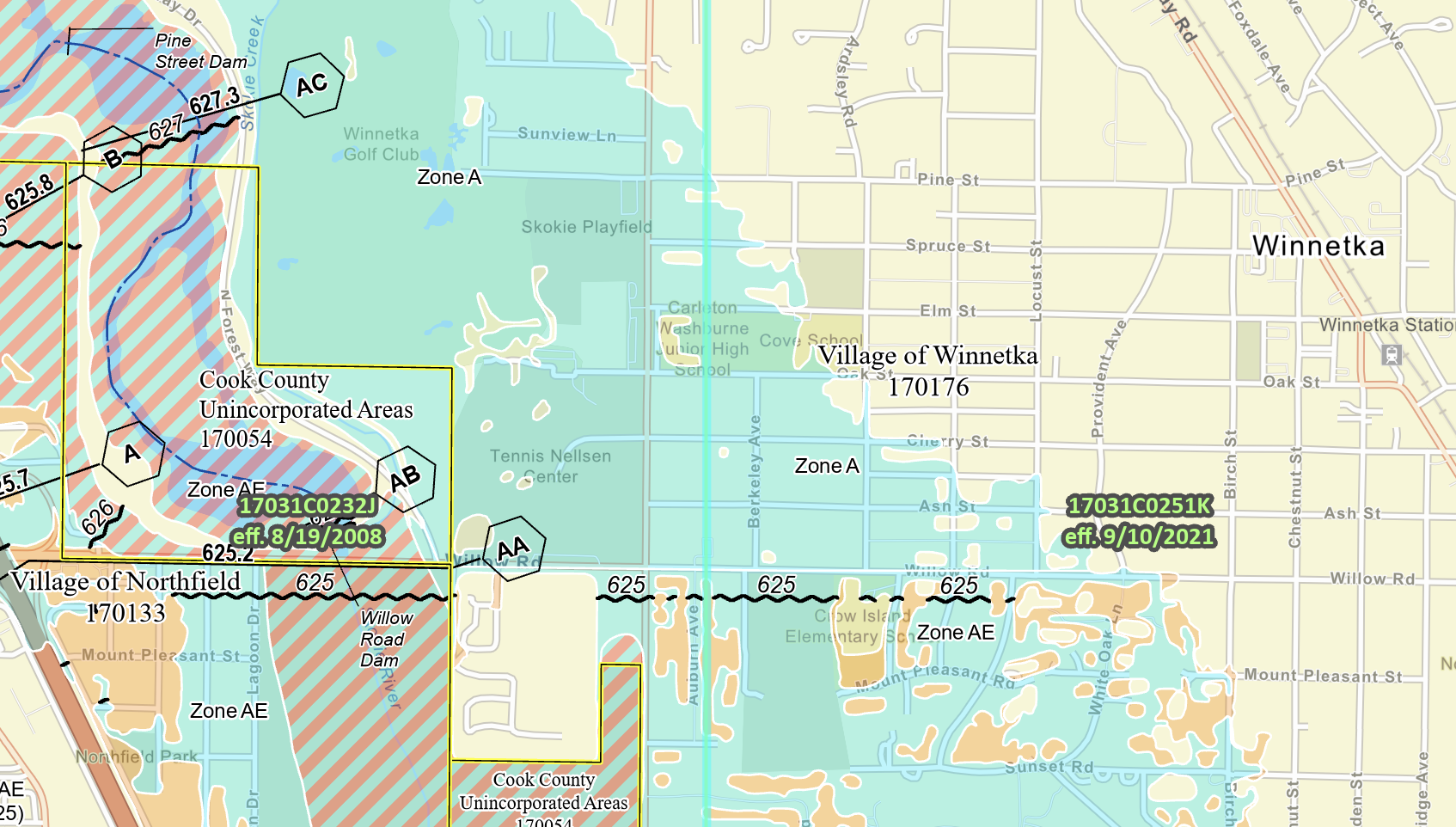

If your property is located in a Special Flood Hazard Area (SFHA)—what FEMA designates as a high-risk flood zone—and you have a federally backed mortgage, flood insurance isn’t optional. It’s mandatory. Even if you’re not in a high-risk zone, your lender may still require coverage based on their own risk assessment.

This requirement isn’t your bank being difficult. It’s protecting their investment in your property, which also happens to protect yours.

NFIP vs. Private Flood Insurance: Understanding Your Options

For decades, the National Flood Insurance Program (NFIP) was essentially your only option. Backed by the federal government and administered through FEMA, the NFIP provides standardized flood coverage with premiums based on flood risk.

However, the private flood insurance market has grown significantly in recent years, and many homeowners now have choices.

NFIP Coverage offers policies up to $250,000 for your dwelling and $100,000 for contents. The program has standard terms, waiting periods (typically 30 days), and rates that are relatively consistent regardless of which insurance agent you work with. If you’re in a high-risk area with a mortgage requirement, NFIP coverage will satisfy your lender.

Private Flood Insurance can often provide higher coverage limits, more flexibility in terms, and potentially competitive pricing depending on your specific property and risk profile. Some homeowners find that private options offer better coverage for less money, particularly if their home has flood mitigation features or if they’re in a moderate-risk area. The catch? Not all private flood policies meet mortgage requirements, which brings us to an important nuance.

The Homeowners Insurance Scenario: Coverage That Doesn’t Check All Boxes

Some carriers, including Erie Insurance, offer water backup coverage that can be extended to cover flood damage on a broader basis than the NFIP. This can be incredibly valuable protection—water backup claims are common on the North Shore, and this coverage can save you significant out-of-pocket expenses when your sump pump fails during a torrential downpour.

However, while this coverage will pay claims related to flooding or water intrusion, it typically doesn’t satisfy mortgage requirements for flood insurance. If your lender requires flood coverage and you’re relying solely on this type of endorsement, you may not be in compliance with your mortgage terms.

This doesn’t mean the coverage is worthless—far from it. It can work beautifully alongside a compliant flood insurance, or as practical coverage for homeowners without mortgage requirements who want protection against water damage.

Making the Right Choice for Your Situation

The best approach depends on your specific circumstances. Start by determining whether you’re in a flood zone that triggers mandatory insurance requirements, Longmeadow can help you check FEMA’s flood map service center online.

Then compare options. Get quotes for both NFIP and private flood policies. Ask specifically whether private policies will satisfy your mortgage requirements if that applies to you. And consider how add-ons like water backup coverage might work with your overall flood protection strategy.

The North Shore’s proximity to Lake Michigan, our network of creeks and drainage systems, and increasingly intense weather events all mean that flood risk is real here—even if it doesn’t feel like it until water is pooling in your finished basement.

The right flood insurance won’t just protect your home. It’ll give you peace of mind that you’re covered when the unexpected happens, and that you’re meeting your obligations to your lender. In a region where a single storm can cause millions in damage across multiple communities, that protection is worth its weight in gold—or at least in sandbags.